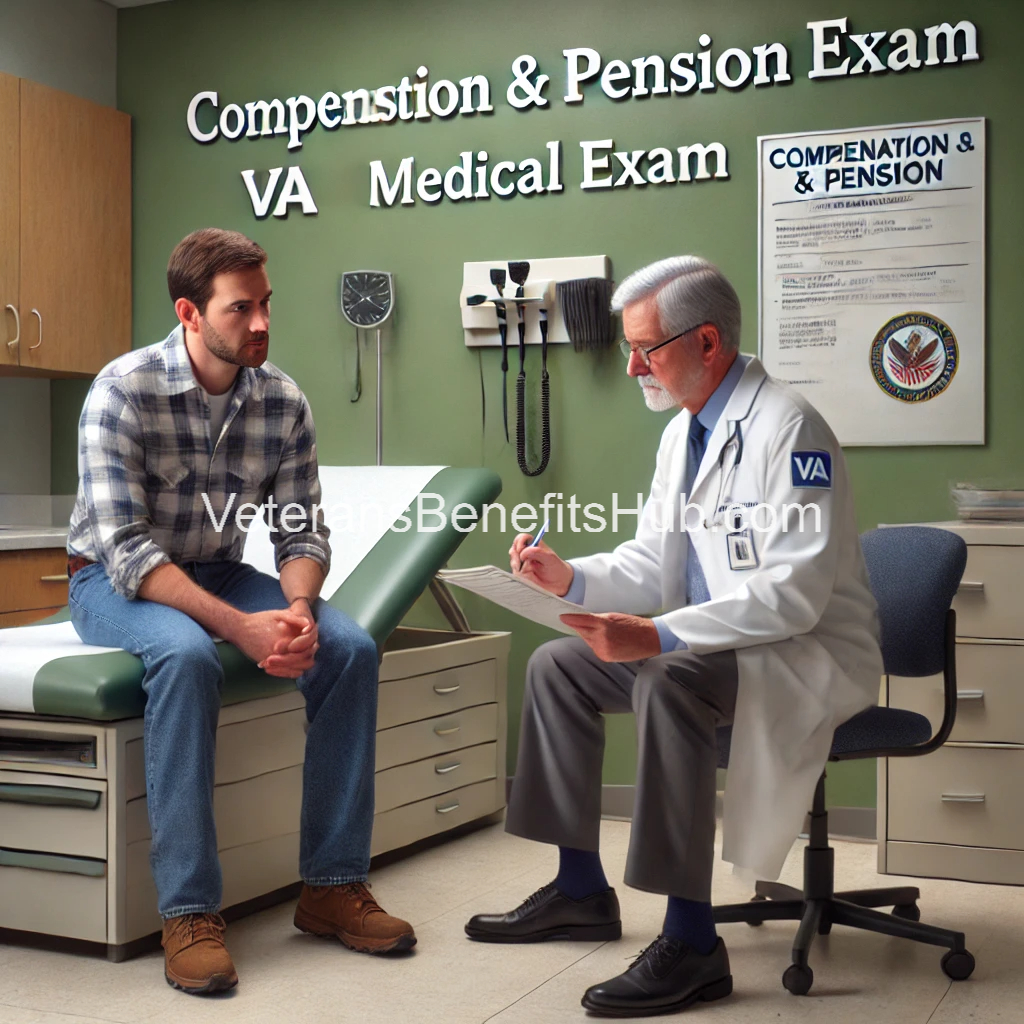

Why Your C&P Exam Is the Most Important Day in Your VA Claim Process

Filing a VA disability claim is just the beginning of the journey toward securing the benefits you rightfully deserve. While gathering medical evidence and submitting a well-documented claim is crucial, the most critical day in the entire process comes after submission—the Compensation & Pension (C&P) Exam. This examination is your opportunity to present your case directly to a VA-appointed examiner, and how you approach it can significantly impact the outcome of your claim.

Understanding the Importance of the C&P Exam

Once you file your VA claim and submit all supporting evidence, much of the process is out of your hands. The VA will review your claim, but the C&P exam is the only time you have direct involvement in demonstrating your disability and its impact on your daily life. Whether the exam lasts five minutes or two hours, preparation is key to ensuring a favorable result.

Establishing Service Connection: Direct vs. Secondary Claims

Before attending your C&P exam, it’s crucial to understand the basis of your claim. Are you filing for a direct service connection (where the disability stems directly from military service), or a secondary service connection (where a service-connected condition has led to another disability)? If you’ve been out of service for more than 12 months, establishing a clear nexus between your military service and your condition becomes even more critical.

A successful claim requires:

- A diagnosis of the condition

- Medical evidence supporting the claim

- A nexus letter from a qualified medical professional linking your condition to service

- Documented symptoms and their impact on your daily life

What Happens During a C&P Exam?

The VA assigns a C&P examiner to assess your disability claim. This individual does not work for you—they are paid by the VA to evaluate your condition, not to provide treatment. Their job is to examine you and report their findings to the VA claims adjudicators.

The examiner may:

- Review your medical history and claim documentation

- Ask you detailed questions about your symptoms and limitations

- Conduct physical or psychological evaluations relevant to your claim

Since this examiner’s report plays a major role in the VA’s final decision, it’s essential to approach the exam strategically.

How to Prepare for Your C&P ExamcExam

One of the best ways to prepare is by reviewing the Disability Benefits Questionnaire (DBQ) for your specific condition. This form outlines exactly what the VA is looking for, allowing you to anticipate questions and provide precise answers.

Key preparation steps include:

- Know your claim details – Stick to discussing only the condition(s) being evaluated.

- Be honest and concise – Answer questions directly without exaggerating or minimizing symptoms.

- Avoid volunteering unnecessary information – If asked a yes-or-no question, keep it that way.

- Discuss your functional limitations – Explain how your disability affects your daily life and ability to work.

- Do not downplay your symptoms – This is not the time to act tough; be clear about the challenges you face.

What NOT to Do at Your C&P Exam

- Do not lie or exaggerate – The examiner will cross-check your responses with your medical records.

- Do not discuss conditions not relevant to the exam – If you filed for PTSD, don’t start talking about your back pain.

- Do not offer unnecessary details – Stay focused on the specific disability being evaluated.

- Do not assume the examiner is on your side – Their job is to assess, not advocate.

Final Thoughts: Nail Your C&P Exam

Your C&P exam is arguably the most important day after you file your VA claim. It determines how the VA will view your condition, so taking the right approach is essential. Be prepared, stay focused, and ensure you present your case effectively.

For more guidance on the VA claims process and securing the right medical evidence, visit VeteransBenefitsHub.com.