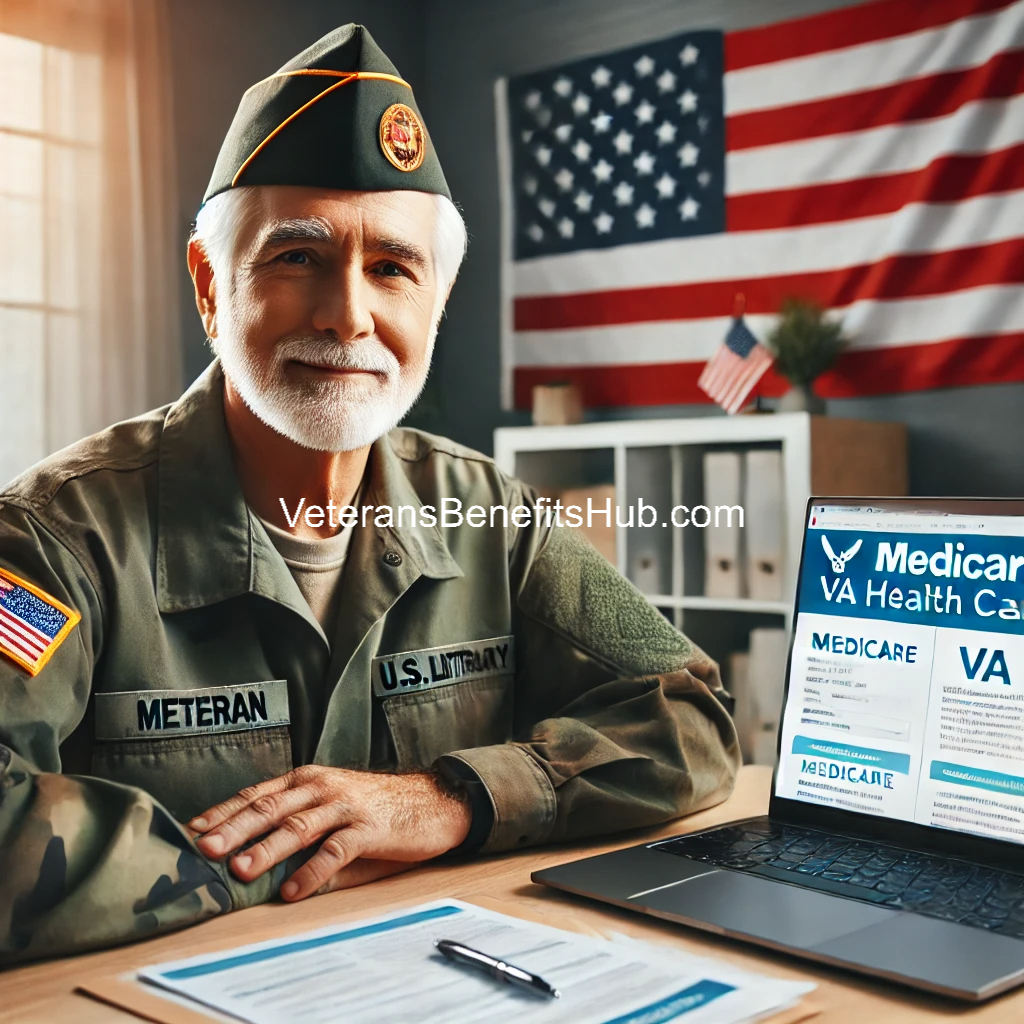

Why Veterans with VA Health Care Should Also Enroll in Medicare

As a veteran enrolled in VA health care, you might wonder about the necessity of enrolling in Medicare upon reaching eligibility. It’s essential to understand that combining VA benefits with Medicare can enhance your health care coverage and provide greater flexibility in accessing services.

Understanding Medicare and Medicare Advantage

Medicare is a federal health insurance program primarily for individuals aged 65 and older, but also for some younger individuals with disabilities. It consists of several parts:

- Part A: Covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

- Part B: Covers certain doctors’ services, outpatient care, medical supplies, and preventive services.

Together, Parts A and B are known as Original Medicare.

Medicare Advantage Plans (Part C) are offered by private insurance companies approved by Medicare. These plans provide all Part A and Part B benefits and often include additional services like prescription drug coverage, dental, vision, and hearing benefits. For instance, some plans inspired by veterans offer dental, vision, and hearing benefits, along with a Part B giveback that adds money back to your Social Security check every month and has a $0 monthly plan premium. These plans do not interfere with VA benefits; instead, they work alongside them to help close gaps in health care.

Why Enroll in Medicare if You Have VA Benefits?

While VA health care provides comprehensive coverage, enrolling in Medicare offers several advantages:

- Expanded Access: Medicare allows you to seek care outside the VA system, providing access to a broader network of doctors and hospitals.

- Flexibility: If you live far from a VA facility or travel frequently, Medicare can offer more convenient options for receiving care.

- Prescription Drug Coverage: With Medicare Part D or a Medicare Advantage Plan that includes drug coverage, you can get medications prescribed by non-VA doctors and pick them up at local pharmacies.

- Coverage Continuity: Having both VA benefits and Medicare ensures that you have continuous coverage in case there are changes in your VA benefits or if you need services that the VA doesn’t cover.

When to Enroll in Medicare

You are eligible for Medicare when you turn 65. The initial enrollment period begins three months before the month you turn 65 and ends three months after. For example, if you turn 65 in April, your enrollment period starts in January and ends in July. It’s advisable to enroll during this period to avoid late enrollment penalties.

Individuals with certain disabilities may be eligible for Medicare before age 65. Additionally, each year, there’s an annual enrollment period from October 15 to December 7, during which you can change or select a Medicare Advantage or prescription drug plan.

Do You Need Prescription Drug Coverage?

If you’re satisfied with your prescription coverage through the VA, you might consider a Medicare Advantage plan without prescription drug coverage. However, if you prefer the convenience of obtaining medications from local pharmacies or need prescriptions from non-VA doctors, enrolling in a plan with Part D coverage could be beneficial.

Reviewing Your Plan Annually

Even if you’re happy with your current plan, it’s important to review it annually. Plan benefits and costs can change each year, so reviewing the information you receive from your insurance carrier ensures that your coverage continues to meet your needs.

Where to Get More Information

Navigating Medicare options can be complex. It’s beneficial to consult with experts who can provide personalized guidance based on your unique situation. Organizations like the State Health Insurance Assistance Program (SHIP) offer free counseling to help you understand your options. Additionally, the official Medicare website provides comprehensive information to assist in your decision-making process.

In conclusion, enrolling in Medicare alongside your VA health benefits can provide enhanced coverage, greater flexibility, and peace of mind as you navigate your health care needs.

For official information and enrollment details, visit the U.S. Department of Veterans Affairs and Medicare.gov.