If you’re a veteran rated at 100% Permanent and Total (P&T), you might wonder whether your VA disability rating is truly secure. Many veterans believe that a P&T rating is untouchable, but the reality is more complex. In this article, we’ll explore whether the VA can reduce a 100% P&T rating, the rules that protect your benefits, and the risks of filing additional claims. This guide aims to help you make informed decisions about your VA disability benefits.

What Does 100% Permanent and Total Mean?

A 100% Permanent and Total (P&T) rating means that the VA considers your disabilities to be both totally disabling (100% rating) and static, meaning they are unlikely to improve over time. As a result, the VA does not schedule routine future examinations to reevaluate your condition. This status provides significant benefits, including full disability compensation, property tax exemptions in some states, and access to a permanent ID card for certain privileges.

However, “permanent” does not always mean “untouchable.” While a P&T rating offers protections, there are scenarios where the VA could propose a reduction.

Can the VA Reduce a 100% P&T Rating?

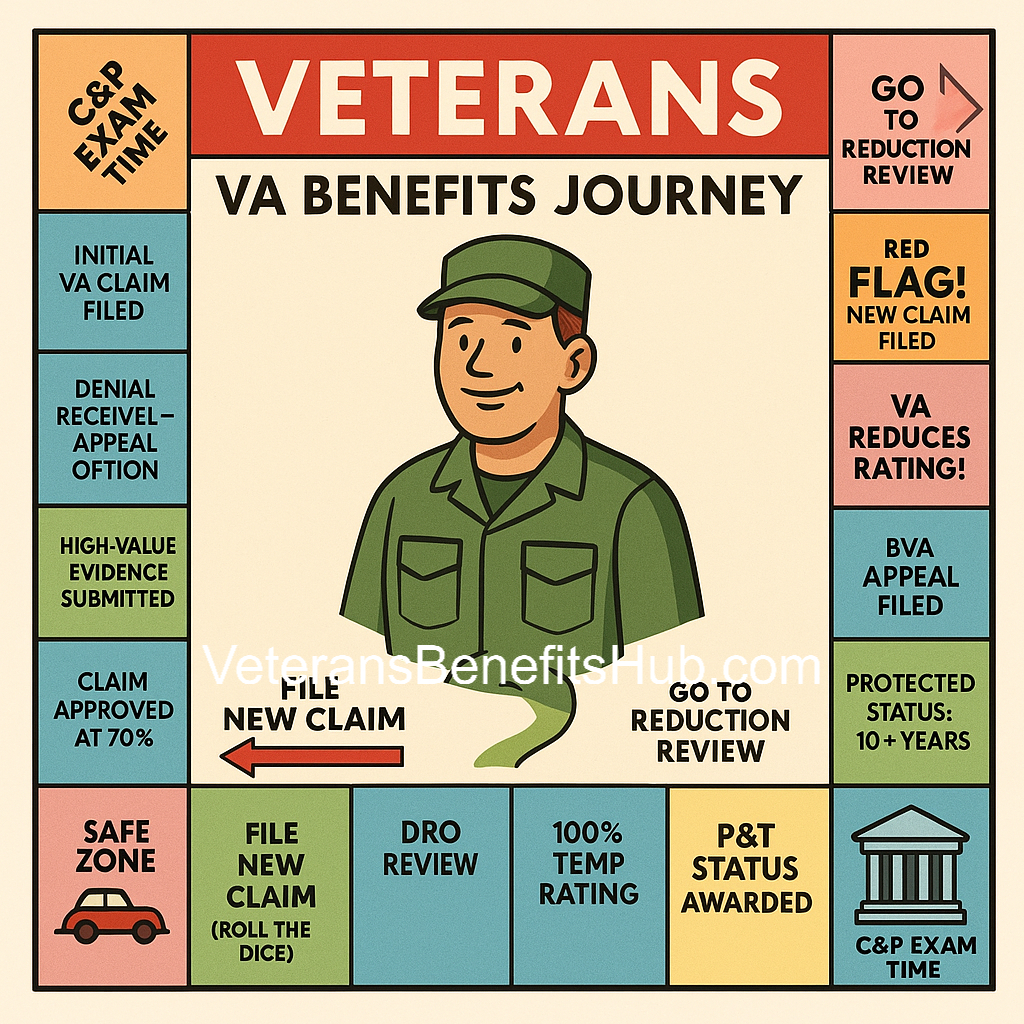

Yes, the VA can reduce a 100% P&T rating, but it’s rare and subject to specific rules. The VA must follow strict guidelines before reducing a protected rating, and several regulations provide safeguards for veterans:

- Five-Year Rule: If your disability rating has been in place for five years, the VA must show clear evidence of sustained improvement in your condition before proposing a reduction.

- Ten-Year Rule: If you’ve held a specific disability rating for 10 years, the VA cannot sever service connection for that condition unless there’s evidence of fraud.

- Twenty-Year Rule: If you’ve held a 100% P&T rating for 20 consecutive years, your rating is fully protected, and the VA cannot reduce it (except in cases of fraud).

- Age 55 Rule: Veterans aged 55 or older are less likely to face reductions, as the VA assumes conditions are less likely to improve with age.

These rules make reductions unlikely for P&T veterans, especially as time passes. However, filing a new claim can reopen your case and potentially expose your rating to review.

Why Filing a New Claim Could Risk Your P&T Rating

Once you’re at 100% P&T, filing an additional claim won’t increase your monthly compensation, as 100% is the maximum rating. For example, even if you have multiple disabilities that add up to 190% or 380% under the VA’s combined rating system, your payment remains at the 100% level. So why do some veterans file new claims?

Some veterans want the VA to acknowledge additional service-connected conditions, such as sleep apnea, for personal validation or to strengthen their medical record. However, filing a new claim or requesting an increase can trigger a review of your existing disabilities. This process could lead to a proposed reduction if the VA determines that one or more of your conditions has improved.

For example, if you file a claim for a new condition and the VA schedules a Compensation and Pension (C&P) exam, they may also reevaluate your P&T conditions. If the exam suggests improvement, the VA could propose reducing your rating, potentially lowering your monthly compensation or affecting benefits tied to your P&T status, such as property tax exemptions or dependent education benefits.

Example Scenario

Consider a veteran with a 100% P&T rating based on disabilities that combine to 190% under VA math. If they file a claim for a new 50% condition, their combined rating might increase to 240%, but their compensation remains at 100%. However, the new claim could prompt a C&P exam, and if the VA finds evidence of improvement in an existing condition, they might reduce the rating—say, from 190% to 140%. While the veteran might still qualify for 100%, a significant reduction could jeopardize P&T status or other benefits.

In contrast, a veteran with a 380% combined rating has more “buffer” room. Even if the VA reduces a few conditions, they might still maintain 100% P&T. Your specific combined rating and medical evidence play a critical role in assessing risk.

When Might Filing a New Claim Make Sense?

There’s one key exception where filing a new claim at 100% P&T might be worth considering: Special Monthly Compensation (SMC). SMC provides additional payments for veterans with specific severe disabilities or combinations of conditions, such as loss of use of a limb or the need for aid and attendance.

For example, qualifying for SMC-S (housebound benefits) or SMC-K (loss of use of a creative organ) could add $100 to $400 or more to your monthly compensation. However, even this comes with risks. If the VA denies your SMC claim and finds evidence of improvement in your P&T conditions during the process, they could propose a reduction.

Before pursuing SMC, weigh the potential increase in benefits against the risk of losing your current compensation. For some veterans, an extra $400 per month may not justify the possibility of a reduction from $3,100 to $2,000, along with the loss of P&T-related benefits.

Protecting Your 100% P&T Rating

To minimize the risk of a reduction, consider these strategies:

- Understand Your Medical Evidence: Ensure your medical records clearly document the severity and permanence of your disabilities. Regular treatment and consistent complaints to your healthcare provider strengthen your case.

- Avoid Unnecessary Claims: If you’re already at 100% P&T and don’t qualify for SMC, think carefully about why you’re filing a new claim. Personal validation may not be worth the risk.

- Wait for the 20-Year Mark: Once you’ve held your 100% P&T rating for 20 years, it’s fully protected (except in cases of fraud). At that point, filing for SMC or other benefits becomes safer.

- Consult a Veterans Service Officer (VSO): A VSO can review your case and help you assess the risks and benefits of filing a new claim.

Final Thoughts

A 100% Permanent and Total rating offers significant protections, but it’s not entirely risk-free. Filing a new claim can reopen your case and potentially lead to a reduction, especially if your medical evidence isn’t strong or you’re far from the 20-year protection mark. Before taking action, carefully evaluate your goals, review your medical records, and consider consulting a VSO to ensure you’re making the best decision for your situation.

Navigating VA claims can be complex, and every veteran’s circumstances are unique. By understanding the rules and risks, you can protect your benefits and make informed choices about your VA disability compensation.

Disclaimer

Some portions of this article reflect the opinions and personal experiences of the author. While the information provided is based on VA regulations and general guidance, it is not legal advice. Veterans should consult with a qualified Veterans Service Officer (VSO) or accredited representative for personalized advice regarding their VA claims. VeteransBenefitsHub.com is not affiliated with the Department of Veterans Affairs.