$100k+ in Benefits Await You!

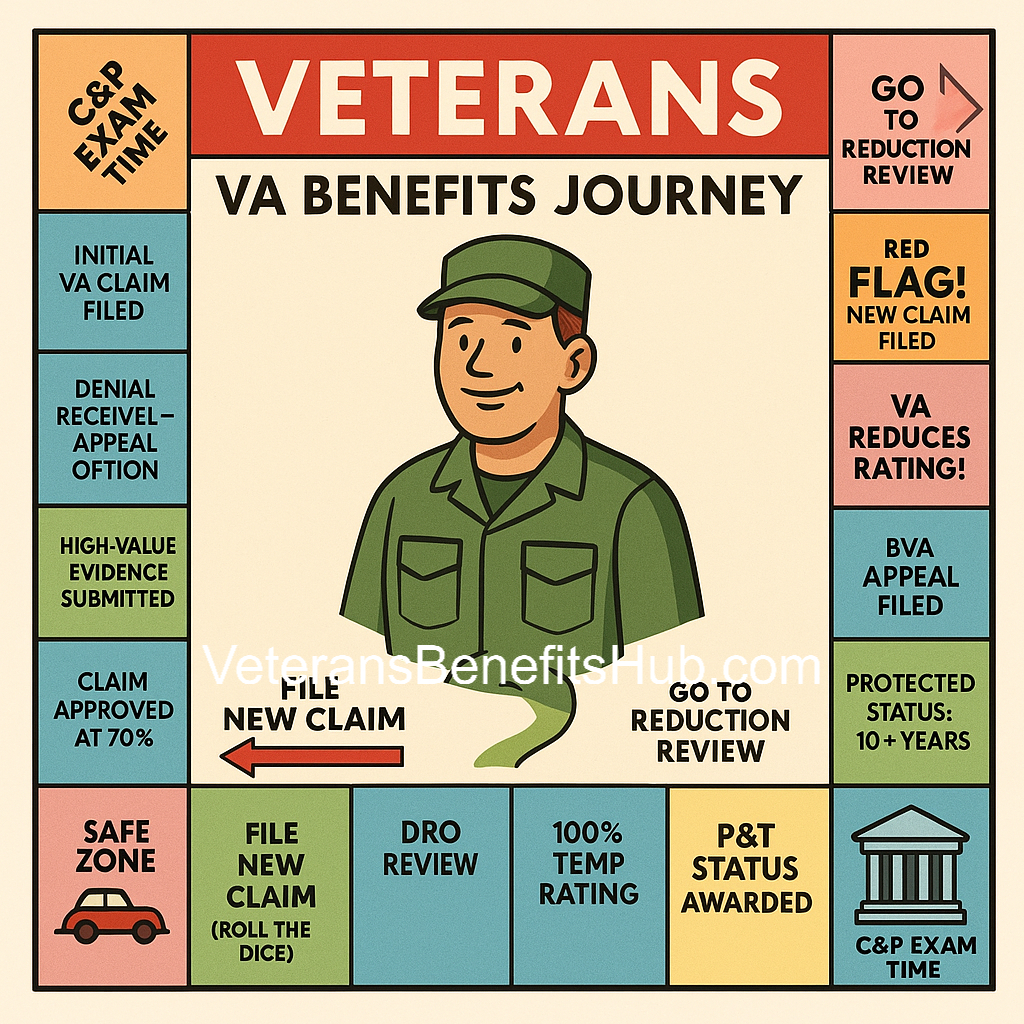

Many veterans may not be fully utilizing the key benefits available to them as 100% disabled veterans — or those who may soon receive such a rating. These benefits, when combined strategically, can significantly impact a household’s financial well-being.

Our contributor, a veteran rated 100% permanent and total (P&T) by the VA, shares insight into how these benefits can be transformative. While the acknowledgment of injury and its lasting impact is important — and no financial compensation can truly account for such loss — understanding and leveraging earned benefits is crucial.

Maximizing VA Disability Income in Loan Applications

One overlooked advantage is how VA disability income is treated by lenders. Typically, this tax-free income is counted at 125% of its value when calculating debt-to-income ratios. For example, $4,000 per month in disability pay is considered as $5,000 by most lenders, allowing for larger loan approvals. This is particularly powerful when combined with other benefits such as the VA Home Loan program.

Through the VA Home Loan, 100% disabled veterans can purchase a home with 0% down payment, no private mortgage insurance (PMI), and no origination fee. In some states, such as Texas and Florida, a full or partial property tax exemption for a primary residence (homestead) is also available. This drastically reduces monthly housing expenses and increases purchasing power.

State-Specific Benefits for Disabled Veterans

States like Texas and Florida provide some of the most comprehensive benefits. Texas, for instance, offers a full property tax exemption for qualifying 100% disabled veterans. Vehicle registration fees are also waived, a benefit which may not seem significant at first glance, but can amount to thousands in annual savings in states like California.

Estimating the Financial Value of a 100% P&T Rating

The overall financial value of a 100% permanent and total disability rating can easily exceed six figures annually when combining VA disability compensation (roughly $50,000 per year), the tax-free nature of this income, waived expenses, and access to free or discounted services.

One major component is free healthcare — often including dental — for both the veteran and their eligible dependents. This coverage can protect against tens of thousands in unexpected medical expenses annually.

Educational Benefits

Veterans and their dependents may access various education benefits beyond the Post-9/11 GI Bill. For example, the Hazlewood Act in Texas and similar programs in Florida allow dependents to pursue higher education with little or no tuition costs. In addition, programs like Folds of Honor can offer up to $5,000 per year toward private schooling or tutoring for children.

Veterans with federal student loans may also have their debt fully forgiven upon receiving a 100% P&T rating, regardless of the amount owed — a critical financial reset for many households.

Altogether, these benefits — when properly understood and utilized — can dramatically improve the financial trajectory of disabled veterans and their families. These are not merely perks; they are earned entitlements that can and should be maximized.

Disclaimer: Some portions of this article represent the personal opinions and experiences of our contributor. While efforts have been made to ensure accuracy, readers should verify details through official VA or state sources.