Introduction: Understanding 100% Disability and P&T Status

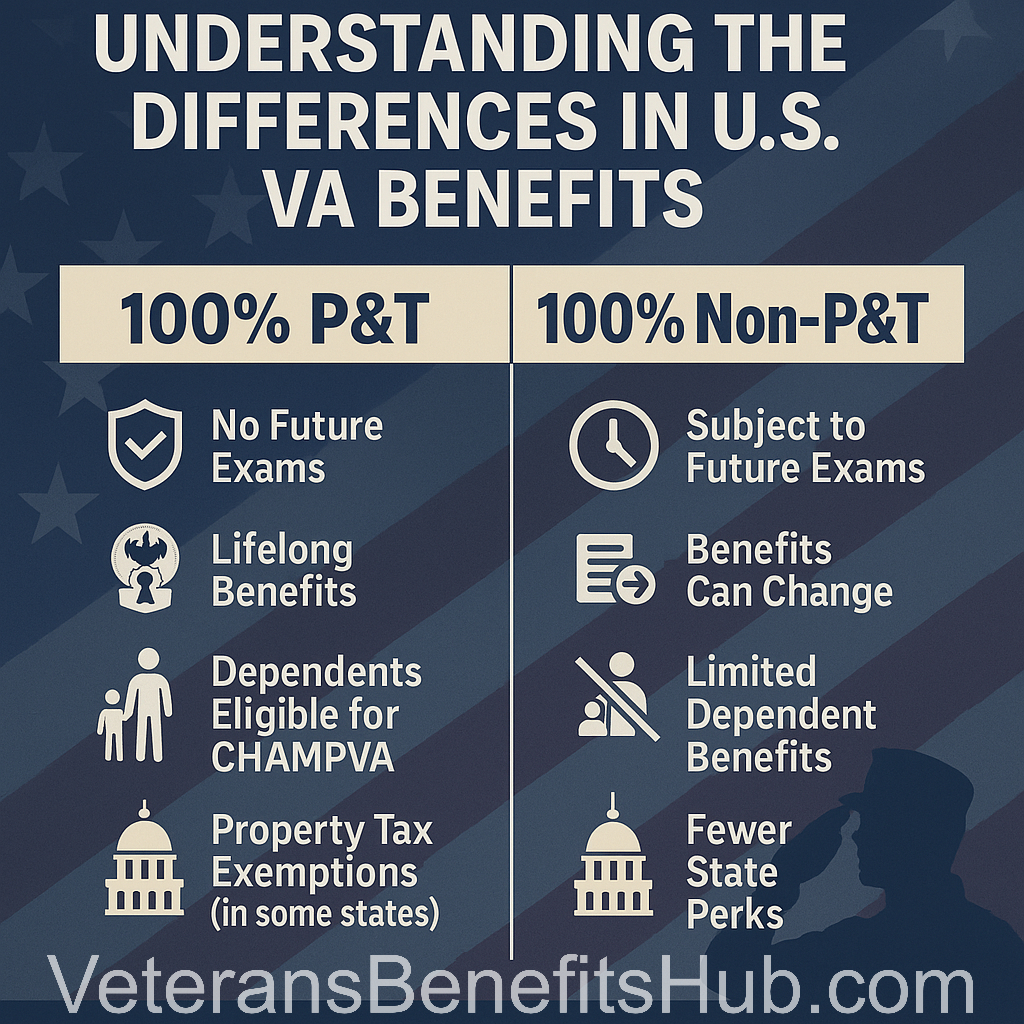

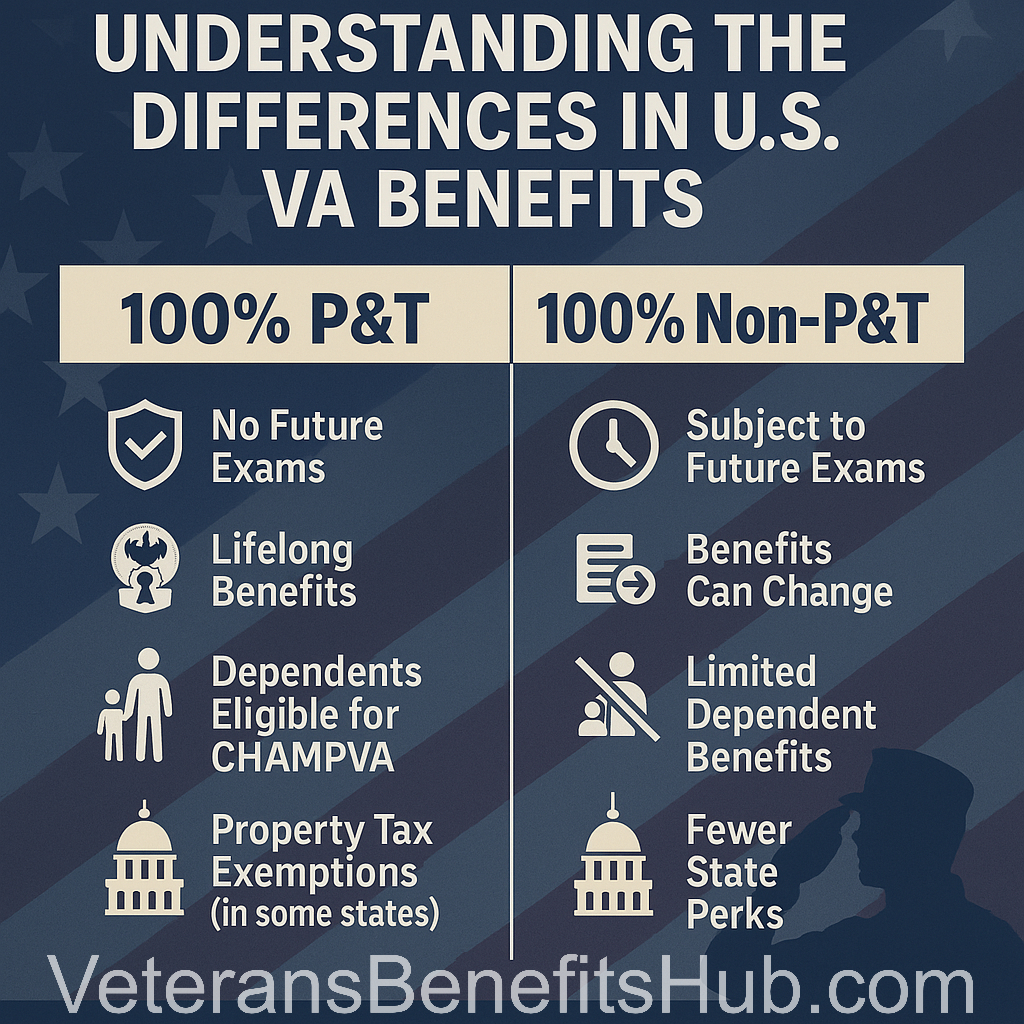

A comprehensive understanding of the benefits offered by the U.S. Department of Veterans Affairs (VA) requires a clear distinction between different disability ratings. Among the most significant are the 100% disability rating and the 100% Permanent and Total (P&T) disability rating. While both signify a high level of impairment resulting from service-connected conditions, key differences exist that affect the scope and security of the benefits received.

Defining 100% Disability Rating

A 100% disability rating, also referred to as a total disability rating, represents the highest level of impairment recognized by the VA for service-connected compensation.1 This designation is reserved for veterans whose service-connected conditions are deemed extremely debilitating.1 This rating can be assigned based on a single, severely impairing condition or as a result of multiple service-connected disabilities whose combined effect reaches the 100% threshold.1 It is also possible for a veteran to receive compensation at the 100% level through Total Disability Based on Individual Unemployability (TDIU), even if their combined disability rating is below 100%. TDIU is granted when service-connected disabilities prevent a veteran from securing and maintaining substantially gainful employment.1 It is important to recognize that a 100% disability rating does not automatically imply that the condition is permanent.1 The VA often schedules regular Compensation and Pension (C&P) examinations to reassess the veteran’s condition and determine if any changes have occurred.1 The initial understanding of a 100% rating might lead one to believe it’s the ultimate and most secure status. However, the distinction between temporary and potentially revisable 100% ratings versus permanent ones is a crucial nuance. A veteran seeing “100%” might assume maximum and lasting benefits. However, without the “P&T” designation, this might not be the case, impacting long-term planning and security.

Defining Permanent and Total (P&T) Disability Rating

The Permanent and Total (P&T) disability rating signifies that a veteran’s disabilities are not only total (rated 100% disabling) but also permanent, meaning there is zero or a very close to zero chance of improvement.1 The VA considers a disability permanent when medical evidence indicates with reasonable certainty that the severity of the condition will continue for the remainder of the veteran’s life.6 Examples of conditions often considered permanent include the amputation of limbs, blindness, or paralysis.5 A significant aspect of the P&T status is that it generally exempts veterans from future scheduled C&P examinations for the specific conditions that contributed to the P&T rating, thus providing greater stability in their benefits.5 Furthermore, the P&T designation often unlocks additional benefits, particularly for the veteran’s dependents.4 The P&T designation acts as a safeguard, offering not only the highest level of compensation but also a sense of security and additional support systems, especially for family members. While a 100% rating addresses the veteran’s immediate needs, P&T extends that security to the future and to the veteran’s family, suggesting a more comprehensive level of support.

Fundamental Differences

The fundamental difference between a 100% disability rating and a 100% P&T rating lies in the permanence of the condition and the associated stability and additional dependent benefits linked to the P&T status.15 A veteran can be rated 100% “Total” without being “Permanent,” which often occurs when the VA anticipates that a disability might improve over time.4 The decision letter from the VA for a P&T rating often explicitly states “Permanent and Total” or indicates the veteran’s eligibility for Dependents Educational Assistance (DEA) under Chapter 35.4 The absence of the “P&T” designation on the rating decision or the lack of automatic approval for DEA serves as a critical indicator that the 100% rating might be subject to review.

Federal Healthcare Benefits

Access to healthcare is a primary concern for disabled veterans. Both a 100% disability rating and a 100% P&T rating provide significant healthcare benefits through the VA. However, differences emerge when considering healthcare for dependents.

VA Medical Care Access for 100% Disabled Veterans (Both P&T and Non-P&T)

Veterans with a 100% disability rating, whether P&T or not, are eligible for no-cost comprehensive healthcare, including dental care and prescription medications, for their service-connected conditions.1 These veterans are placed in Priority Group 1 for VA healthcare, which is the highest priority group. This ensures they receive the most comprehensive coverage and the highest level of access to a wide range of medical services.2 These services include emergency care, preventive care, primary care, specialty care, mental health services, home health care, the provision of prosthetics, and essential medical devices such as hearing aids and eyeglasses.2 Furthermore, comprehensive dental care benefits are available to veterans with a service-connected disability rated at 100% or those who receive TDIU due to their service-connected disabilities.2 In terms of direct healthcare access for the veteran themselves, a 100% rating, regardless of P&T status, grants the highest priority and comprehensive no-cost care within the VA system. The evidence suggests that the veteran’s own healthcare within the VA is primarily tied to the 100% rating itself, not necessarily the permanent designation.

CHAMPVA Eligibility (Civilian Health and Medical Program of the Department of Veterans Affairs)

The Civilian Health and Medical Program of the Department of Veterans Affairs (CHAMPVA) provides free civilian healthcare coverage for the dependents of certain veterans.2 A crucial distinction arises here: eligibility for CHAMPVA is typically linked to the veteran being rated 100% permanently and totally disabled due to a service-connected disability or being permanently and totally disabled due to a service-connected condition at the time of death.2 This means that dependents of veterans with a 100% non-P&T rating may not be eligible for CHAMPVA coverage.19 CHAMPVA represents a significant disparity in healthcare benefits, where the P&T designation acts as the key that unlocks comprehensive civilian healthcare for the veteran’s family. While the veteran’s healthcare is covered at 100%, the dependents’ healthcare through CHAMPVA is contingent on the “Permanent” aspect of the disability rating. This has major implications for family well-being and financial security.

Other Healthcare-Related Benefits

Both categories of 100% disabled veterans are generally eligible for medically related travel benefits to cover the costs of transportation to and from scheduled VA healthcare appointments.1 The VA also offers long-term care services and in-home care services, although the available information does not explicitly differentiate access to these services based on P&T status.16 Similarly, the VA’s Caregiver Support Program provides resources, training, counseling, and financial assistance to those caring for 100% disabled veterans, without a clear distinction between P&T and non-P&T in the provided snippets.16 While the core healthcare benefits for the veteran are similar, the P&T designation provides a much broader safety net by including dependent healthcare coverage through CHAMPVA. Comparing the healthcare benefits reveals that the primary distinction lies in the coverage extended to family members, making P&T a critical factor for veterans with dependents.

Financial Compensation

Financial compensation is a cornerstone of the benefits provided to disabled veterans. While the basic monthly disability compensation is the same for both categories of 100% disabled veterans, additional financial advantages often favor those with the P&T designation.

Monthly Disability Compensation Rates

Veterans with a 100% disability rating receive the maximum monthly VA disability compensation, which is provided tax-free.2 The amount of this compensation increases for veterans who have eligible dependents.1 The current VA disability compensation rates for a 100% disability rating, effective December 1, 2024, are detailed in the table below 3:

Table 1: Current VA Disability Compensation Rates for 100% Disability (Effective December 1, 2024)

|

Dependent Status

|

Monthly Rate (USD)

|

|

Veteran alone (no dependents)

|

3,831.30

|

|

With spouse (no parents or children)

|

4,044.91

|

|

With spouse and 1 parent (no children)

|

4,216.35

|

|

With spouse and 2 parents (no children)

|

4,387.79

|

|

With 1 parent (no spouse or children)

|

4,002.74

|

|

With 2 parents (no spouse or children)

|

4,174.18

|

|

Veteran with 1 child only (no spouse or parents)

|

3,974.15

|

|

With 1 child and spouse (no parents)

|

4,201.35

|

|

With 1 child, spouse and 1 parent

|

4,372.79

|

|

With 1 child, spouse and 2 parents

|

4,544.23

|

|

With 1 child and 1 parent (no spouse)

|

4,145.59

|

|

With 1 child and 2 parents (no spouse)

|

4,317.03

|

|

Each additional child under age 18

|

+106.14

|

|

Each additional child over age 18 in qualifying school

|

+342.85

|

|

Spouse receiving Aid and Attendance

|

+195.92

|

The basic monthly compensation rates are the same for both 100% P&T and 100% non-P&T rated veterans.16 This table clearly shows the base amount and the additional amounts based on dependents, which are applicable to both P&T and non-P&T 100% rated veterans. This addresses a core part of the user’s query regarding financial compensation. Data is sourced from the official VA website, ensuring accuracy.

Additional Financial Advantages Linked to P&T Status

Beyond the basic monthly compensation, several additional financial advantages are often specifically linked to the 100% permanently and totally disabled status. One significant benefit is the potential for property tax exemptions, which are frequently offered by states to veterans with the P&T designation.16 This can result in substantial long-term financial savings for these veterans. While a waiver of the VA funding fee for home loans is available to all 100% disabled veterans, likely including both P&T and non-P&T 1, the Total and Permanent Disability (TPD) discharge program for federal student loans is also available to 100% disabled veterans, potentially including both categories.16 However, the snippets do not specify any particular advantage for P&T status within the TPD program. While the direct monthly compensation is the same, P&T status often unlocks significant indirect financial benefits, such as property tax exemptions, which can substantially improve the veteran’s financial well-being over time. The evidence consistently points to property tax exemptions as a benefit often tied specifically to the “Permanent” designation, suggesting a key financial advantage beyond the monthly payment.

Dependency and Indemnity Compensation (DIC)

Dependency and Indemnity Compensation (DIC) is a tax-free monthly benefit paid to eligible survivors of certain deceased veterans.4 For the spouse and dependent children to be eligible for DIC based on the veteran’s disability rating, the veteran typically must have held a 100% permanent and totally disabled rating under specific conditions related to the duration of the rating prior to their death.4 The eligibility for DIC provides a critical long-term financial safety net for the surviving family members of a veteran with a 100% P&T rating, which might not be available if the veteran only had a non-permanent 100% rating. The information emphasizes the link between P&T status and DIC eligibility, particularly concerning the duration of the 100% rating before death. This suggests a significant difference in survivor benefits.

Benefits for Dependents

The P&T designation often significantly enhances the benefits available to a veteran’s dependents, particularly in the areas of education and healthcare.

Dependents Educational Assistance (DEA) – Chapter 35

The Dependents Educational Assistance (DEA) program, also known as Chapter 35, provides education and training benefits to eligible dependents of veterans who are permanently and totally disabled due to a service-connected disability.4 The approval of DEA benefits is often a clear indication that the VA has determined the veteran’s disabilities to be “Permanent and Total”.4 These benefits can be used for a wide range of educational pursuits, including college degrees, vocational training, apprenticeships, and other approved educational programs, typically for up to 45 months.4 Importantly, DEA benefits continue for eligible dependents even if the veteran has passed away, regardless of the cause of death, provided the veteran was rated P&T.5 The DEA program is a significant benefit exclusively or primarily linked to the P&T status, providing crucial educational opportunities for the veteran’s dependents, even in the event of the veteran’s death. The evidence consistently associates DEA eligibility with the P&T designation, highlighting a major difference in benefits for the veteran’s family.

Other Dependent-Specific Benefits

Veterans with a combined VA disability rating of 30% or higher can receive additional VA disability compensation for their dependents; this benefit is applicable to both 100% P&T and non-P&T veterans 1, and the added amounts are included in Table 1. Special Restorative and Vocational Training for Dependents is another benefit mentioned, which appears to be available to dependents of 100% disabled veterans, although the snippets do not explicitly differentiate between P&T and non-P&T status for this particular benefit.16 Some states also offer education benefits for dependents of 100% disabled veterans, and these may prioritize or be exclusive to those with P&T status.5 For instance, the Children of Veterans Tuition Grant in Michigan specifically includes children of veterans who have been awarded a total and permanent disability rating from the VA.20 While some dependent benefits might be available to both categories, the key differentiator is the comprehensive educational support offered through Chapter 35 DEA, which is strongly tied to the P&T designation. Comparing dependent benefits reveals that DEA stands out as a significant advantage for P&T veterans’ families, underscoring the importance of this designation for long-term family well-being.

Burial and Memorial Benefits

The VA offers various burial and memorial benefits to eligible veterans and their families. While some benefits are generally available to all veterans who served honorably, the P&T status can influence eligibility for certain survivor benefits.

VA Burial Allowance

The VA provides burial allowances to help cover the funeral costs of eligible veterans.1 The amount of the allowance depends on whether the veteran’s death was service-connected and if the veteran was hospitalized by the VA at the time of death.23 The current burial allowance amounts, effective October 1, 2024, are detailed in the table below 25:

Table 2: Current VA Burial Allowance Amounts (Effective October 1, 2024)

|

Condition

|

Maximum Burial Allowance

|

Maximum Plot Allowance

|

|

Service-connected death (on or after September 11, 2001)

|

Up to $2,000

|

Some transport costs

|

|

Non-service-connected death

|

$978

|

$978

|

|

Non-service-connected death (Veteran hospitalized by VA at time of death)

|

$978

|

$978

|

Eligibility for burial in a VA national cemetery is generally the same for all veterans who served under honorable conditions.23 This table provides a clear overview of the burial allowances, which are relevant to both categories of veterans. It highlights that the primary factor determining the allowance amount is the service connection of the death, not the P&T status of the veteran at the time of death.

Dependency and Indemnity Compensation (DIC) and Burial

As previously mentioned, Dependency and Indemnity Compensation (DIC) eligibility for surviving spouses and children often hinges on the veteran having a 100% P&T rating for a specified period before death, particularly for non-service-connected deaths occurring after 10 years of the veteran holding the rating.4 For service-connected deaths, the DIC eligibility criteria may differ, but the evidence suggests that P&T status can still be a significant factor, especially if the death occurs within 10 years of the veteran achieving the 100% rating.4 While the basic burial allowance might be similar for both 100% and 100% P&T veterans, the P&T status can significantly impact the long-term financial support available to survivors through DIC, especially in cases where the death is not directly service-connected or occurs after a more extended period. The connection between P&T status and DIC eligibility for survivors in the context of burial and death benefits highlights another crucial advantage of the permanent designation.

Other Federal Benefits

Beyond healthcare, compensation, and dependent benefits, both 100% and 100% P&T disabled veterans may be eligible for a range of other federal benefits. However, some nuances exist.

Home Loan Benefits

Veterans with a 100% disability rating, whether P&T or not, are eligible for a waiver of the VA funding fee for home loans.1 Additionally, Disability Housing Grants are available to veterans with certain service-connected disabilities, though the provided information does not specify if P&T status offers any distinct advantage in eligibility for these grants.20

Travel Allowance

As previously noted, both categories of 100% disabled veterans are eligible for a travel allowance to cover the costs of traveling to scheduled VA healthcare appointments.1

Commissary and Exchange Privileges

Veterans with a 100% disability rating are eligible to shop at military commissaries and exchanges, offering tax-free shopping and discounts on a wide range of goods. This benefit likely applies to both P&T and non-P&T veterans.16

Space-Available Travel on Military Aircraft

One potential benefit that might be exclusive to 100% P&T veterans is space-available travel on military aircraft. While some sources mention this as a benefit for 100% disabled veterans 16, it is not definitively stated if a P&T designation is required. Further investigation into the specific regulations governing this benefit would be necessary for complete clarity.

Federal Hiring Preference

Both 100% disabled veterans and those with a 100% P&T rating receive a 10-point preference in federal hiring, providing them with an advantage in the competitive federal job market.16 The Direct Hire Authority for Federal Jobs may also be available to veterans with a 100% disability rating.16

National Parks and Federal Recreational Lands Pass

A significant benefit for outdoor enthusiasts is the free lifetime access pass to over 2,000 federal recreation areas, including national parks, wildlife refuges, and national forests, which is available to 100% disabled veterans.16

VA Life Insurance

The landscape of VA life insurance options is somewhat complex. Veterans with a 100% schedular or TDIU rating (which can be either P&T or non-P&T) may be granted a $10,000 Service-Disabled Veterans Life Insurance (S-DVI) policy with waived premiums under specific conditions, such as having received a new service-connected disability rating within the past two years.4 However, S-DVI is closed to new enrollment.27 The Veterans Affairs Life Insurance (VALife) program, launched in 2023, is available to veterans with any service-connected disability rating (0-100%) and offers coverage up to $40,000, but it does not include a premium waiver option.28 While some federal benefits are available to all 100% disabled veterans, the specific criteria for benefits like premium-waived life insurance might depend on factors beyond just the 100% rating, such as the nature and timing of the service-connected condition. P&T status might indirectly influence eligibility for certain programs or provide more favorable conditions.

State-Level Benefits

In addition to federal benefits, many states offer their own benefits to disabled veterans. These benefits can vary significantly from state to state, and the P&T designation often plays a crucial role in determining eligibility.

Property Tax Exemptions

Many states offer property tax exemptions for disabled veterans, and a significant number of these provide full exemptions specifically for veterans who are rated 100% permanently and totally disabled.16 For example, in Michigan, a property tax waiver is available to veterans who are 100% permanently and totally disabled, those entitled to veterans benefits at the 100% rate, or those rated as individually unemployable.20 State-level benefits, particularly significant ones like property tax exemptions, often hinge on the veteran having the P&T designation, creating a substantial difference in the overall benefits package based on this status and the state of residence. The Michigan example clearly shows that while a 100% rating is a prerequisite, the “Permanent and Total” aspect is often explicitly required for full property tax exemption, indicating a key state-level advantage of P&T.

Vehicle Registration

Some states offer reduced or no-cost vehicle registration for disabled veterans. For instance, Michigan provides this benefit to veterans who have a total and permanent disability rating from the VA.20

Hunting and Fishing Licenses

Certain states, such as Michigan, offer free hunting and fishing licenses to 100% disabled veterans, often with the stipulation that the disability is permanent and total.20

Other State-Specific Benefits

A variety of other state-level benefits may be available, including resources for college, employment assistance programs, and housing assistance. Eligibility for these benefits can vary and may be influenced by the veteran’s P&T status.5 The variability of state-level benefits underscores the importance of veterans understanding the specific advantages offered by their state of residence, and the P&T status often serves as a key eligibility criterion for the most significant of these benefits. The examples of vehicle registration and hunting/fishing licenses in Michigan further reinforce the trend that P&T status is often the gateway to valuable state-level benefits.

Stability of Disability Rating

One of the most significant advantages of the P&T designation is the stability it provides regarding future medical re-evaluations.

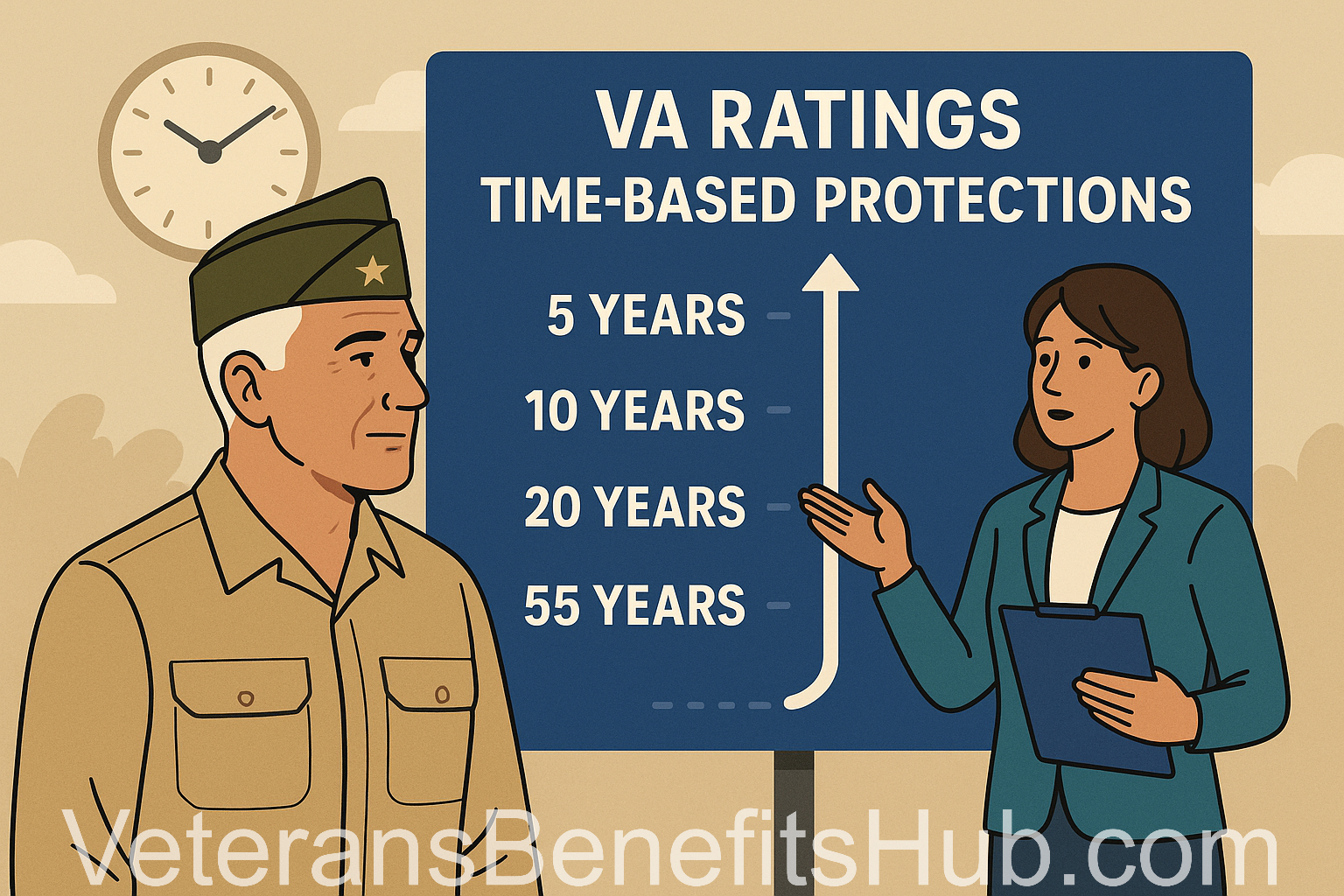

Routine Future Examinations (RFEs)

Veterans who have a 100% disability rating that is not designated as Permanent and Total are generally subject to routine future examinations (RFEs), also known as C&P exams, to reassess their medical conditions.1 This means that their disability rating could potentially be reduced in the future if the VA determines that their conditions have improved.1

Exemption from RFEs with P&T Status

In contrast, veterans with a 100% P&T rating are typically exempt from these scheduled re-evaluations for the conditions that led to their P&T status. This provides a greater sense of security and long-term stability in their disability benefits.5

Exceptions to P&T Protection

It is important to note that even with a P&T rating, the VA may still conduct re-evaluations under specific circumstances. These exceptions include situations where there is evidence of fraud related to the original rating, if a VA Quality Review finds a Clear and Unmistakable Error (CUE) in the initial rating decision, or if the veteran files a new claim that could potentially impact the original P&T conditions.8 Additionally, a 100% disability rating that has been in place for 20 years or more is generally considered protected from reduction unless there is evidence of fraud.1 The most significant advantage of the P&T designation, beyond specific benefits, is the stability it provides by reducing the likelihood of future re-evaluations and potential rating reductions, offering long-term security for the veteran and their family. The contrast between the possibility of re-evaluation for non-P&T 100% ratings and the general exemption for P&T ratings underscores a fundamental difference in the security and peace of mind associated with each status.

Conclusion: Key Distinctions and Overall Impact

In summary, while both a 100% disability rating and a 100% Permanent and Total (P&T) disability rating signify the highest level of service-connected impairment recognized by the VA, the P&T designation carries significant advantages, particularly concerning benefits for dependents and the long-term stability of the rating.

Key distinctions include:

- Healthcare for Dependents: Eligibility for CHAMPVA, which provides free civilian healthcare coverage for dependents, is generally contingent upon the veteran having a 100% P&T rating.

- Educational Assistance for Dependents: The Dependents Educational Assistance (DEA) program under Chapter 35 is primarily available to dependents of veterans with a P&T rating and continues even after the veteran’s death.

- Property Tax Exemptions: Many states offer full property tax exemptions specifically for 100% permanently and totally disabled veterans.

- Stability of Disability Rating: Veterans with a 100% P&T rating are generally exempt from routine future medical re-evaluations, providing greater long-term security in their benefits.

While both categories of veterans receive the same basic monthly disability compensation and have access to comprehensive healthcare within the VA system, the P&T designation unlocks crucial additional benefits, especially for dependents, and offers enhanced security against potential rating reductions. The P&T designation represents a more comprehensive and secure level of support from the VA, extending beyond the individual veteran to their dependents and providing long-term stability that a non-permanent 100% rating might lack. Understanding the nuances between these two ratings is vital for veterans and their families to ensure they are aware of and can access all the benefits to which they are entitled.

Works cited

- What Does It Mean to Be 100% Disabled by the VA? – CCK Law, accessed April 12, 2025, https://cck-law.com/types-of-va-disabilities/what-does-it-mean-to-be-100-percent-disabled-by-the-va/

- The 2025 Benefits List for Veterans and Dependents | Hill & Ponton, P.A., accessed April 12, 2025, https://www.hillandponton.com/additional-benefits-for-100-percent-disabled-veterans/

- Current Veterans Disability Compensation Rates | Veterans Affairs, accessed April 12, 2025, https://www.va.gov/disability/compensation-rates/veteran-rates/

- ADDITIONAL BENEFITS WHEN RATED 100% DISABLED BY THE VA – Nashville.gov, accessed April 12, 2025, https://filetransfer.nashville.gov/portals/0/sitecontent/HumanResources/Veterans%20Services/ADDITIONAL%20BENEFITS%20WHEN%20RATED%20100.pdf

- How Do I Get a Permanent and Total (P&T) Disability Rating?, accessed April 12, 2025, https://vadisabilitygroup.com/how-do-i-get-a-permanent-and-total-pt-disability-rating/

- Permanent Versus Total Disability for VA Ratings – Veterans Guardian, accessed April 12, 2025, https://vetsguardian.com/blog/permanent-versus-total-disability-for-va-ratings/

- Can You Work With 100% VA Disability Permanent and Total?, accessed April 12, 2025, https://disabilitylawgroup.com/practice-areas/tdiu-and-permanent-and-total-disability-requirements/can-i-be-100-permanent-total-and-work/

- Can VA Take Away 100% Permanent and Total (P&T) Disability? – CCK Law, accessed April 12, 2025, https://cck-law.com/blog/can-va-take-away-100-percent-permanent-and-total-p-and-t-disability/

- TDIU, Permanent and Total Disability Requirements – Free Consult, accessed April 12, 2025, https://disabilitylawgroup.com/practice-areas/tdiu-and-permanent-and-total-disability-requirements/

- How Do I Get a 100% VA Permanent and Total Disability Rating (P&T)?, accessed April 12, 2025, https://vaclaimsinsider.com/va-permanent-and-total-disability/

- How to Get Permanent and Total Disability From the VA (4-Step Process Explained), accessed April 12, 2025, https://vaclaimsinsider.com/how-to-get-permanent-and-total-disability-from-the-va/

- vadisabilitygroup.com, accessed April 12, 2025, https://vadisabilitygroup.com/how-do-i-get-a-permanent-and-total-pt-disability-rating/#:~:text=Simple%20examples%20of%20a%20permanent,your%20condition%20will%20not%20improve.

- How to Get a Permanent and Total Disability Rating from VA | CCK Law, accessed April 12, 2025, https://cck-law.com/blog/how-to-get-a-permanent-and-total-disability-rating-from-va/

- How To Get 100 Percent VA Disability Rating – Veterans Guide, accessed April 12, 2025, https://veteransguide.org/va-disability/ratings/how-to-get-100-percent/

- 100% vs 100% P and T : r/VeteransBenefits – Reddit, accessed April 12, 2025, https://www.reddit.com/r/VeteransBenefits/comments/13nza2r/100_vs_100_p_and_t/

- The 50 BEST 100 Percent VA Disability Benefits (2025 Ultimate Guide), accessed April 12, 2025, https://vaclaimsinsider.com/best-benefits-for-100-percent-disabled-veterans/

- cck-law.com, accessed April 12, 2025, https://cck-law.com/types-of-va-disabilities/what-does-it-mean-to-be-100-percent-disabled-by-the-va/#:~:text=Other%20VA%20Benefits%20for%20100%25%20Disabled%20Veterans&text=No%2Dcost%20health%20care%2C%20dental,Vocational%20Rehabilitation%20%26%20Employment

- VA Benefit Eligibility Matrix, accessed April 12, 2025, https://benefits.va.gov/benefits/derivative_sc.asp

- List of 100 VA Disability Entitlements: The Ultimate Guide, accessed April 12, 2025, https://vaclaimsinsider.com/100-va-disability-entitlements/

- Benefits for 100 Percent Disabled Veterans – State of Michigan, accessed April 12, 2025, https://www.michigan.gov/mvaa/quality-of-life/quality-of-life/benefits-disabled-vet

- Current Disability Compensation Rates – Veterans Benefits Administration – VA.gov, accessed April 12, 2025, https://www.benefits.va.gov/compensation/rates-index.asp

- The Comprehensive Guide to VA 100% P&T Benefits – Vets Forever, accessed April 12, 2025, https://vetsforever.com/blog/va-100-pt-benefits/

- Veteran Burial Benefits Explained: What You Need to Know – DAV, accessed April 12, 2025, https://www.dav.org/get-help-now/veteran-topics-resources/memorial-death-benefits/

- VA Benefits For Family And Caregivers | Veterans Affairs, accessed April 12, 2025, https://www.va.gov/family-and-caregiver-benefits/

- Burial Benefits – Compensation, accessed April 12, 2025, https://www.benefits.va.gov/compensation/claims-special-burial.asp

- Veterans Burial Allowance And Transportation Benefits, accessed April 12, 2025, https://www.va.gov/burials-memorials/veterans-burial-allowance/

- Service-Disabled Veterans Life Insurance (S-DVI) – VA.gov, accessed April 12, 2025, https://www.va.gov/life-insurance/options-eligibility/s-dvi/

- What is the difference between VA Life Insurance and Service-Disabled Veterans Life Insurance? – VA News, accessed April 12, 2025, https://news.va.gov/109922/difference-va-life-insurance-sdvi/

- Veterans Affairs Life Insurance (VALife), accessed April 12, 2025, https://www.va.gov/life-insurance/options-eligibility/valife/