Unlock Six Figures: Combining SSDI and VA Disability

How Veterans Are Earning Over $100K Per Year—Tax-Free—by Combining VA and SSDI Benefits

There’s a little-known but highly effective method that veterans are using to increase their household income—by combining their VA disability compensation with Social Security Disability Insurance (SSDI). This approach can generate upwards of $100,000 per year in income, with a significant portion of it being tax-free.

If you’re a veteran with a VA disability rating—whether it’s 100% or less—you may also qualify for SSDI. And yes, you can receive both at the same time.

Meet Jordan Anderson

Jordan Anderson, a 100% rated Air Force veteran and founder of VA Claims Academy, has helped thousands of veterans achieve the VA ratings they deserve. Many of them have also successfully applied for SSDI, dramatically increasing their total household income.

VA Disability vs. SSDI: Key Differences

VA disability compensation is paid for service-connected conditions. SSDI, on the other hand, is designed for any condition—service-connected or not—that limits your ability to work.

Although managed by different agencies, documentation from your VA claim (such as C&P exam results, doctor notes, and treatment history) can be used as strong medical evidence for your SSDI application. If you’re rated 100% Permanent and Total (P&T), your SSDI claim—and even your appeals—can be expedited.

Qualifying for SSDI

To qualify for SSDI, you need a specific number of work credits based on your age. If you’re over 31, you typically need 20 credits earned within the 10 years prior to becoming disabled. Fortunately, your military service time counts toward these credits.

TDIU and SSDI

If you’re rated as TDIU (Total Disability based on Individual Unemployability), your documentation of unemployability can provide compelling evidence for your SSDI claim. Both programs focus heavily on your inability to work, which makes this synergy very powerful.

Medical Evidence Is Everything

The success of your SSDI claim will largely depend on the quality and quantity of your medical evidence. The nexus letters and personal statements you submitted for your VA claim may be reused to support your SSDI application.

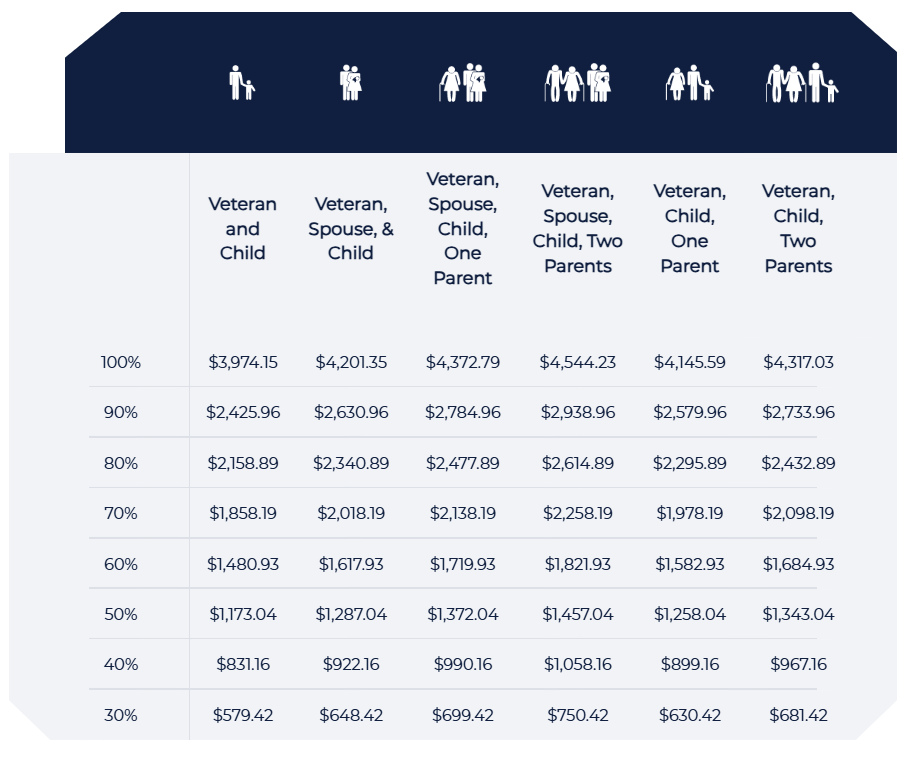

How Much Can You Earn?

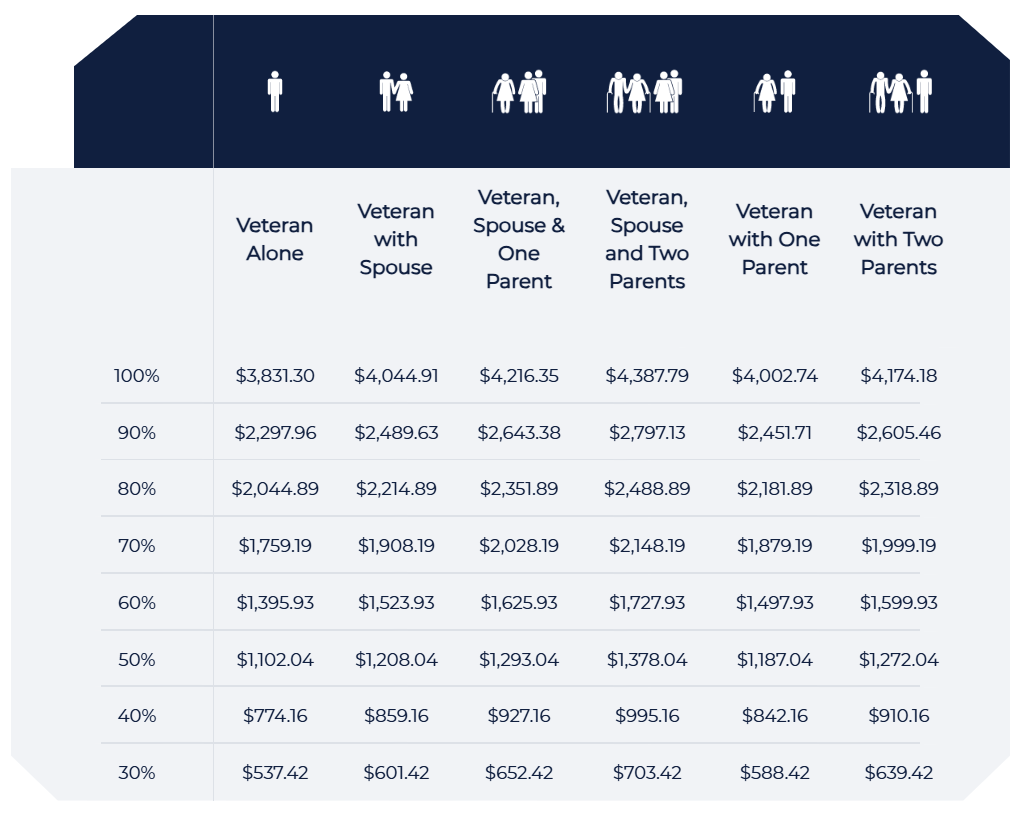

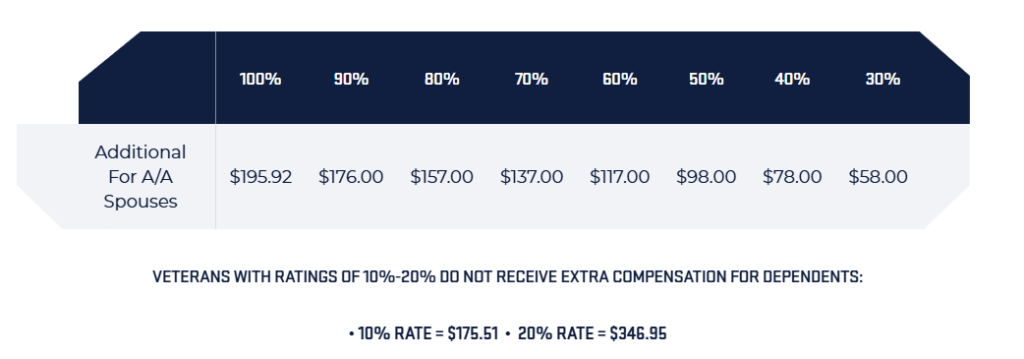

A veteran receiving 100% P&T VA compensation typically receives around $4,000/month—nearly $50,000/year. SSDI benefits can also approach $4,000/month, depending on your prior earnings. Combined, that’s close to $100,000/year.

And remember, your VA compensation is completely tax-free. This gives it a much higher effective value—comparable to a taxable salary of around $70,000–$75,000. The combined income could be worth even more than six figures annually.

Important Caveats

- You can still work a job if you’re 100% P&T from the VA—unless you’re on TDIU, in which case working is not allowed.

- SSDI has strict income limits. Even passive income, like rental property income, can sometimes be counted and affect your eligibility.

Final Thoughts

If your service-connected disabilities are preventing you from working, it’s worth exploring whether you’re eligible for SSDI in addition to your VA benefits. The financial and emotional relief this combination brings can be life-changing for you and your family.

Don’t leave benefits on the table. Talk to a qualified Social Security disability professional to explore your options fully.

Disclaimer: This article is provided for informational and educational purposes only. It reflects the personal opinions and experiences of veterans and is not legal or financial advice. Please consult with a certified claims representative or licensed professional regarding your specific circumstances.